What is breakdown cover?

Breakdown cover is a type of policy that covers you in the event your vehicle breaks down. There are many circumstances where this type of cover helps, such as if you get a flat tyre or puncture, or your car doesn’t start.

Is breakdown cover included with my motor insurance?

This depends on your car insurance policy, but in most cases you have to buy breakdown cover separately or add it as an optional extra to your policy. If you’re not sure whether your insurance already includes vehicle breakdowns, it’s best to check your policy documents first.

Get a Flux Rescue Breakdown Cover Quote

How much is breakdown cover?

The cost of breakdown cover varies depending on a number of factors, what type of vehicle you’re driving, and more. Rest assured that our cover is one of the most affordable policies available on the market; our cover for breakdowns includes UK and European roadside assistance and recovery, as well as a home start service – all from just £65.00 a year.

Plus, if you purchase breakdown cover alongside vehicle insurance, we offer a fantastic reduced rate of:

- £65 for cars

- £62 for bikes

- £45 for classic bikes

- £45 for classic and kit cars

- £99 for motorhomes

- £99 for vans or pickups (between 2550kg and 3,500kg)

Other Extra Benefits

Breakdown

Flux Rescue Breakdown Cover

Get comprehensive breakdown cover from just a year that offers 24 hour UK and EU roadside assistance and recovery, 365 days of the year.

With cover provided for breakdown and recovery, transport to your home, destination of choice, or a garage for you and five passengers, emergency accommodation expenses, home start service, and breakdown cover for your caravan or trailer too, you can get fantastic protection without breaking the bank.

Our breakdown helplines are open 24 hours a day, 365 days of the year, and we have a network of more than 1,800 breakdown experts across Europe, so you’re only ever one phone call away from help.

Courtesy Car

Courtesy Car

Being stuck without a courtesy car following an accident can not only make it hard to get around, but also stand in the way of going to work, doing the weekly shop, and enjoying your spare time.

Many people assume that every car and van insurance policy provides a courtesy car as standard, only realising too late that it isn’t the case. In fact, most non-comprehensive policies will not offer you a courtesy car, and there are even situations where having a comprehensive policy won’t guarantee you one.

Make sure that you always have access to a courtesy car by adding one to your Adrian Flux motor policy. Just ask one of our team about how we can help.

Flex Drive

Drive Any Car Insurance

There are many reasons you might need to drive someone else’s car, either in an emergency or as part of an agreement.

While many policies include third party cover for you to drive any vehicle, this often leaves you liable for the full cost of your own damage caused in the event of an accident.

Our Flex Drive car insurance extends your cover to include accidental damage cover on the vehicle you’re driving, just like a fully comprehensive policy. It covers claims up to £20,000 on any car you use.

That extra cover will give you the confidence to drive any vehicle, with the owner’s permission, at any time.

Keycare

Keycare Insurance

If you’ve ever lost your keys, you’ll know that it’s no laughing matter, and can in fact end up costing you a lot of money in locksmith fees.

For just a year, our five-star Keycare insurance policy will cover locksmith expenses, replacement locks and keys, car immobiliser replacement costs, car hire costs, and transport costs if you’re stranded, up to a value of £1,500.

We’ll pay out if your keys are stolen, locked inside your home or vehicle, or lost for 48 hours. Better yet, your keys are protected regardless of your location; we now cover keys worldwide.

For more information and to add Keycare to your policy, speak to a member of our team today.

Free Legal Expenses Insurance

Free Legal Expenses Insurance

Finding good legal representation after an accident which wasn’t your fault can be a nightmare, and while the family solicitor may seem like the obvious answer, in most cases your local firm will not be specialists in motor claims.

Our legal expenses cover will cover costs involved in taking civil legal action after the accident to recover any uninsured losses such as death or injury, policy excess, loss of earnings, vehicle repairs, an alternative vehicle, damage to personal property and towing, vehicle recovery and storage.

The policy we offer will cover you for up to £100,000 worth of legal expenses and hire of a vehicle, provided you use the solicitor appointed to pursue your claim. This comes free with all our Motor Insurance policies.

Misfuel

Misfuelling Insurance Cover

A staggering 400 people every day put the wrong fuel in their car – that’s 150,000 people every year!

The damage caused by filling your car or van up with the wrong fuel can be catastrophic, and lead to hundreds, if not thousands, of pounds worth of repairs being carried out.

With misfuel cover, as long as you’ve realised your error before driving away we’ll cover draining the fuel from your car, tow you to a garage if we can’t help at the pump, and provide £10 of fuel to get you on your way again.

Pothole Cover

Pothole Insurance

Did you know that if you claim on your car insurance policy for pothole damage, you’ll probably lose your no claims bonus and will have to pay your excess, leading to increased insurance costs when you renew?

With the number of potholes skyrocketing in the UK, it’s now more important than ever to protect your vehicle in the event you run over one.

At Adrian Flux, we offer pothole damage insurance as an extra benefit to your car insurance policy. That’s added protection for your car, your no claims bonus, and your wallet.

Gadget Insurance

Gadget Insurance

Is there anything more annoying than your mobile phone breaking, or your laptop deciding not to turn on?

Gadgets have virtually become an extra limb in the 21st century, so why wouldn’t you protect your mobile phone, laptop, games console or tablet in the same way you would protect your home or car?

For as little as per year, you can have peace of mind that your gadgets are insured, should they be damaged, suffer a mechanical failure or stolen, wherever you are in the world and are covered up to £1,500 per claim without affecting your home insurance no claims bonus. Whatsmore there are no limits on the amount of gadgets on your policy.

Adrian Flux specialists have access to a national network of companies so you can be confident of getting a fast and efficient service, should the worst happen to your gadgets.

Goods in Transit

Goods in Transit Insurance

Goods in transit insurance is designed to cover anyone who uses their vehicle for transporting goods professionally, whether they’re documents, materials, or packages.

Whether you work as a courier, delivery driver, or in the haulage industry, having the right cover for your cargo, whatever it is, can make the world of difference, and save you money and a headache, if something bad should happen.

To find out more about how you can get insurance for transporting goods, and what’s covered, speak to our team today.

Home Emergency Cover

Home Emergency Cover

From leaking pipes to blocked drains, electrical failures to boiler breakdowns, if emergency strikes, having the right insurance can save you time, headaches, and money.

With home emergency insurance from Adrian Flux, you can get your home covered for a wide variety of issues, with tailored cover and flexible payment options, keeping you safe year-round without breaking the bank.

To find out more about our home emergency cover, and all of our home insurance policies, speak to a member of our team today.

Home Legal Protection

Home Legal Protection Insurance

There are 50,000 reasons why home legal protection cover, or family legal protection, is a smart idea.

Home legal protection cover provides peace of mind against the threat of being sued and, in the event that you have to pursue a civil claim, it will provide cover for your legal expenses, up to a certain amount.

Home legal protection provides up to £50,000 indemnity for you and the people that matter to you: the family you live with, your spouse or partner, your parents or parents-in-law, and your children under the age of 21.

There are four main areas of cover: Personal Injury, Your Home, Services & Personal Property and Employment.

Keycare for Landlords

Keycare for Landlords

As a landlord, losing the keys to your rental properties, or having them stolen, can pose both an enormous headache and a big financial burden.

With Adrian Flux’s keycare insurance for landlords, we can cover the cost of replacement keys, changing locks, and locksmith fees for your properties.

Landlord Legal Protection

Landlord Legal Protection

Starting at just , Adrian Flux’s landlord legal expenses insurance provides up to £100,000 cover for property legal disputes, attendance expenses and rent recovery costs from your tenants.

An extra level of cover, available from just [upsell-price code=”rent-guarantee”], can also extend to include up to £50,000 advisor’s costs per claim for rent guarantee and provide payments of up to £1,000 per month to cover rent payments missed by your tenants.

To find out more about our landlord legal cover and rent protection, click find out more, or call to speak to our team.

Rent Guarantee

Landlord Legal Protection + Rent Guarantee

Adrian Flux’s landlord legal expenses insurance provides up to £100,000 cover for property legal disputes, attendance expenses and rent recovery costs from your tenants.

An extra level of cover, available from just , can also extend to include up to £50,000 advisor’s costs per claim for rent guarantee and provide payments of up to £1,000 per month to cover rent payments missed by your tenants.

To find out more about our landlord legal cover and rent protection, click find out more, or call to speak to our team.

Personal Accident

Personal Accident Cover

Personal accident cover, also sometimes referred to as auto extra cover, can be hard to find, and while you may believe your insurance covers you for all injuries, this is not the case.

While nobody likes to think of the possibility of being seriously injured in an accident, unfortunately it can happen. Adrian Flux can offer you personal accident cover, if you are unfortunate enough to suffer a bodily injury in the event of an incident and you can’t claim compensation from another party.

We will pay you an amount to help you financially following an injury the sum insured for any of the following: accidental death, total and permanent loss of sight in one or both eyes, loss of a limb or permanent disability. The policy will cover you for up to £100,000 for any one accident causing bodily injury, in line with warranties and conditions.

Personal Possessions

Personal Possessions Insurance

No matter how careful you are, ensuring your personal possessions are safe in your vehicle, can be trickier than you may think.

There’s always a risk of theft from your vehicle, no matter how well you hide items in your boot or glovebox. That’s why personal possessions cover is vital.

Adrian Flux’s personal possessions insurance is specifically designed to protect your items, whether that’s gadgets, sports/hobby equipment or camping gear left in your car, van, camper or caravan.

Our policy covers your personal effects in a car, van, camper or caravan up to £1,000 and a low excess of only £50 – providing insurance for a wide range of personal effects against fire and lightning damage, malicious damage, storm and flood and theft from a locked vehicle.

Public Liability

Public Liability Car Insurance

Protect yourself from liability costs with our public liability car insurance, available from . Ideal in the event you or your vehicle damages someone else’s property or causes accidental bodily injury.

Public liability car insurance can protect you should you:

Display your car in a car show or exhibit: give us a call if you regularly attend and exhibit in car shows and you require legal cover.

Work as a driving instructor: we offer driving instructor insurance for ADIs and PDIs. Public liability cover can be added to your insurance with little extra fuss.

Work as a courier: you can easily add public liability cover to your self-employed courier van insurance.

Spare Parts

Spare Car Parts Insurance

Whether you own spares for your kit car or are in the process of modifying your day-to-day motor, are collecting parts for a future mod or have just got a few old spares lying around, your standard insurance policies could be leaving your vehicle spare parts dangerously unprotected.

Sadly, most household insurance policies exclude cars and their unattached parts, and even those that do offer cover could end up costing you dearly with high excesses and the premium rises after a claim.

But, with Adrian Flux’s Spare Parts Insurance, you can get cover for storing thousands of pounds worth of spares at home or in your car from as little as .

Tools

Tools In Transit Insurance

For just a year, you could claim for damage, loss, or theft of tools up to £5,000 whilst they’re being driven in your van, loaded or unloaded, or stored in your van over night.

There’s no denying that the tools of your trade are vital to your business, so you need to know that if they’re lost or damaged that you can afford to replace them and get back to work as soon as possible.

With a low £100 excess for each claim, and cover for theft, loss, or damage, you can be confident that even if the worst happens, we’ll help you to get new tools and get back on the job quickly.

Total Loss Protection

Total Loss Protection Insurance

Total Loss Protection helps bridge the gap between what you paid for your car and the insurance payout you receive if it is written off in an accident.

While your vehicle insurance policy will pay out the vehicle’s current market value, Total Loss Protection insurance cover will top this up by 25 percent, up to a maximum of £10,000.

For as little as a year, the Total Loss Protection policy will give you extra funds to help you buy a suitable replacement car more in keeping with the one you have lost.

If you sell your vehicle, providing no claims have been made under the policy, you can transfer the cover to your new one.

Track Days

Track Day Insurance

Track days can be thrilling, whether you are part of a car club, or with a group of friends. The majority of car insurance providers do not cover track events, so it is important you have specialist track day insurance for when you and your car are tearing up the tarmac.

Adrian Flux are pleased to offer cover for a wide variety of track day events from just [custom_popup_price] per day, making this fun-filled hobby more accessible and affordable for all.

Track day events insurance includes cover for the following:

- Track days

- Hill climbs

- Drag strips

Travel Insurance

Flexible Travel Insurance

Whether you’re lounging on the beach or hitting the slopes, having the right travel insurance can mean the difference between the holiday of a lifetime and a financial headache.

Providing up to £5,000 if your trip is cancelled or cut short, up to £15million medical expenses, £250 money and document cover, £2,000 baggage cover, and £2million personal liability insurance, you’ll be fully covered, no matter what happens.

Click find out more to get more information, or speak to a member of our team today to get your quote.

Windscreen Cover

Windscreen Cover

Most fully comprehensive motor insurance policies provide free windscreen cover – we think that’s a smashing deal!

If you notice a chip in your windscreen, you might think it’s not a problem but left untreated it could turn into a crack but driving with a cracked windscreen could be considered a motoring offence if it is deemed to impair your view. And that crack can quickly get worse and shatter the windscreen.

Our specialist windscreen cover will meet the cost of the repair or replacement of your windscreen in the event of it being damaged saving you hundreds of pounds in some cases.

Adrian Flux has access to a national network of windscreen replacement companies so you can be confident of getting a fast and efficient repair.

Helmet & Leathers

Helmet and Leathers Insurance

However carefully you ride, the roads can be a dangerous place for bikers, and there’s no getting away from the fact that a good helmet and proper protective clothing are essential. But good quality helmets and leathers can be expensive, and if you do come off, they are likely to be damaged, even if they have saved you from a serious injury.

So it makes sense to protect them with a helmet and leathers insurance policy.

Our helmet and leathers policy costs just £29.99, and covers £1,500 worth of your protective clothing, including your helmet, boots, gloves and leathers, against loss and damage in the event of a motorcycle accident within the United Kingdom.

We also cover up to £3,000 worth of protective gear for just £39.99.

Company Car NCB

Company Car No Claims Bonus

Many insurers are unwilling to accept bonuses earned in company cars on private car policies, which can leave drivers unfairly paying over the odds for insurance, despite their many years of claim-free driving.

At Adrian Flux, we work with insurance companies that accept company car no claims bonus to help you get a fair deal on your private car insurance.

Once we receive confirmation from your employer or ex-employer of how many years company car insurance no claims bonus you earned, we can apply an equivalent discount to the insurance quote for your own car.

SORN & Build Up Cover

Laid-up Insurance, SORN Insurance and Build-up Cover

Even when your car is unused and parked in a garage, it can be damaged by accident or by fire and can even be targeted by thieves and criminals. To help keep your motor intact while you aren’t using it, we can offer laid-up insurance.

From kit cars being built to SORN insurance, cars laid-up in need of repairing, to ones you only use seasonally – whatever your reason for keeping a vehicle off the road, we can find you cover.

We are also able to offer insurance for cars that won’t be used on the road, but aren’t laid-up. We have policies available for track cars, show cars and even purely off-road cars (vehicle must have a unique identification number, such as a chassis or engine number); as long as you won’t be driving on the road you could get discounted insurance to help cover your motoring hobbies.

Maplin Dash Cam

Maplin Dash Cam

Every year on Britain’s roads thousands of motorists are caught out by fraudsters using so-called ‘crash for cash’ schemes, or find themselves the victim of accidents and crashes that weren’t their fault.

Licence Defence

Licence Defence Motorist Legal Assistance

Drivers facing speeding tickets, allegations of careless driving, or claims of other motoring offences, often struggle to deal with what can be a confusing whirlwind of paperwork, legal processes and police interviews. And without the right advice and assistance, many of those drivers risk making bad decisions that make already difficult situations even worse.

Agreed Value

Agreed Value Car Insurance

Owning a car that you really care about makes it all the more important to get proper compensation should you need to make an insurance claim. Our agreed value car insurance is a great way of tailoring your insurance to you.

A wide range of vehicles, from classics and performance cars to modified cars and imports, would benefit from guaranteed value car insurance. Phone us now to see if your car is one of them.

Home Keycare

Home Keycare

For just a year, we can cover the costs involved with getting back inside your house, whether your keys have been stolen, locked inside your home or vehicle, or lost for 48 hours. We provide you with a fob and can cover all the keys attached to it, including those for your home, car and office.

Our keycare insurance covers the cost of replacing your keys, changing the locks, and hiring a locksmith up to a value of £1,500 per fob per year.

Better yet, there’s no excess to pay; all you have to pay is the annual charge of .

For more information and to add keycare to your policy, speak to a member of our team today.

Courtesy Motorhome

Courtesy Motorhome

No one likes to have an accident, and having one in your motorhome whilst on a trip, is even worse.

A lot of policies will include a vehicle while yours is being repaired if you have comprehensive cover, but what if you write your vehicle off – or it’s stolen or has a fire, or if you only have third party, fire and theft cover? Many people don’t realise in those situations a courtesy car isn’t available.

At Adrian Flux we offer you a hire vehicle in the unfortunate event that this happens. This easy add-on to your policy ensures your travels don’t need to end abruptly, and gives you peace of mind when on the road.

Just ask one of our team about how we can help you add one to your Adrian Flux motor policy.

Excess Protect

Excess Protect

Even though having the right insurance can save you money when you need to claim, your policy excess could still run into hundreds of pounds.

Our excess protect policies will pay your excess for you, up to an annual limit, if you need to make a claim on your policy – saving you money.

The amount of excess you have to pay depends on your policy and can be found on your policy documents. If you opted for a voluntary excess this is an extra amount on top of your compulsory excess, which can bring your premiums down, but is payable on top of your compulsory excess when you make a claim.

We offer excess protect cover at different levels to suit your policy. Speak to a member of our team to find out more and to add it to your policy.

Tenant Pet Damage Cover

Pet Damage Insurance for Tenants

Allowing pets in your rental property can attract more tenants, but it also comes with more risks. From scratched floors to chewed furniture, even the best behaved pets can leave their mark on your property.

With pet damage insurance for tenants from Adrian Flux, you can rent your property to pet owners with confidence, knowing you’re protected against pet-related damages. Our tailored coverage helps you avoid costly repair bills and maintain a great relationship with your tenant.

To learn more about our tenants’ pet damage insurance and how it can benefit you, speak to a member of our team today.

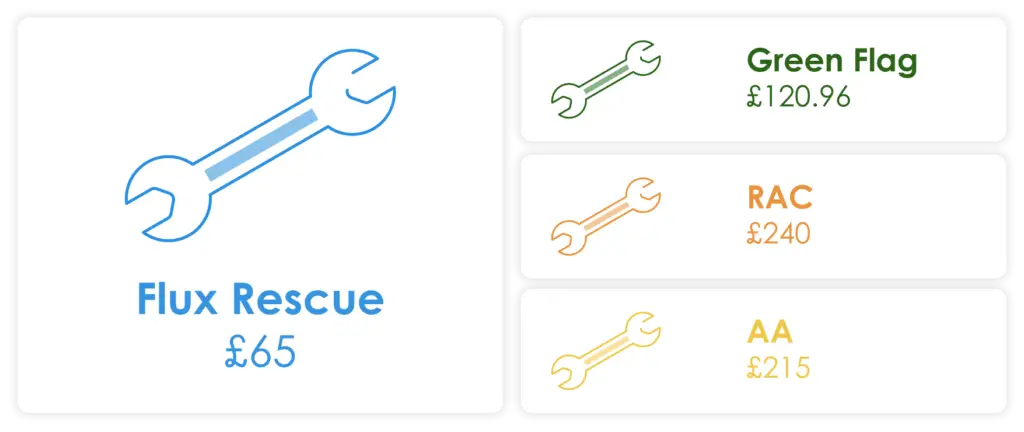

How does the cost of Flux Rescue compare to other insurance company’s breakdown cover?

Flux Rescue offers great value cover for a great price. Similar levels of cover offered by the AA and RAC are nearly double the price.

Do I need breakdown cover?

Although breakdown cover isn’t a legal requirement, it can be useful as you never know when your vehicle might break down unexpectedly. Taking out cover for breakdowns provides peace of mind that, even if your car stops working, you’ll get the help you need to continue your journey with little fuss.

Get a Flux Rescue Breakdown Cover Quote

How does breakdown cover work?

Getting help after a breakdown couldn’t be easier. Simply call the number on your breakdown policy (open 24/7), let us know what’s happened and where you are, and we’ll organise the rest with the nearest local approved recovery agents.

What does Flux Rescue breakdown cover include?

Whether you’re driving locally or in Europe, Flux Rescue offers great value for money and peace of mind. Cover includes the following:

Roadside assistance

Even if you breakdown on the road, Flux Rescue includes roadside assistance to help you get back up and running again. Not only do we arrange for a local approved recovery agent to meet you at the scene of the breakdown, but we also cover the call-out fees and labour charges involved with the agent starting your vehicle.

If the vehicle cannot be repaired quickly at the scene of the breakdown, Flux Rescue will arrange national recovery and pay the reasonable cost of taking the vehicle, plus you and up to five passengers, from the place where the vehicle has broken down to the nearest available garage.

Vehicle recovery

If the vehicle cannot be repaired at the scene of the breakdown or the same day at a suitable garage, Flux Rescue will arrange and pay the reasonable cost of taking the vehicle, you and up to five passengers from the place where the vehicle broke down to a place of your choice.

Home service

If the vehicle breaks down at your home or within one mile of your home, we will arrange help and pay any call-out fees and labour charges needed to start the vehicle. If the vehicle cannot be repaired quickly at the scene of the breakdown, Flux Rescue will pay the reasonable cost of taking the vehicle to the nearest available garage.

European breakdown cover

To help keep you and your party mobile while in most EU countries, we also provide you with additional benefits, including the cost of recovering the vehicle to your home if it cannot be repaired before your planned return date, or costs incurred in travelling from your home or holiday location to the scene of the breakdown to collect the vehicle after repair. Cover only applies for trips of 60 days or less and limited to 60 days per period of insurance.

Get a Flux Rescue Breakdown Cover Quote

Which types of vehicles can I get breakdown cover for?

We offer breakdown cover for all types of vehicles, including classic cars, private and commercial vans, recovery trucks, and more.

Classic car breakdown cover

A classic car is more prone to breaking down, making it all the more important to get breakdown cover. Not having the right cover could leave you stranded in the middle of nowhere with a huge bill to boot.

And with all the time and money invested in keeping your pride and joy running, you probably don’t want to face another hefty expense – especially when it could be avoided so easily.

There are also many dangers involved with breaking down on a motorway or dual carriageway, not only to yourself but also your classic car. Having active breakdown cover helps you get rescued faster, reducing the likelihood of your car getting damaged.

Our breakdown cover puts you in contact with a local approved garage, meaning we’re able to respond quickly when needed.

Commercial vans

There’s no worse time to break down than while you’re delivering goods to customers. Ensure you can get back on track as quickly as possible by taking out breakdown cover for commercial vans. We can provide a similar vehicle for hire so you can keep working.

Private vans

Breaking down is always stressful, and it can be doubly so if you’re taking a trip in your private van with family or helping a friend move. When you call us, we aim to have you back on the road as soon as possible.

Recovery trucks

Recovery trucks are expensive and heavy vehicles, so if your recovery truck breaks down, it can be difficult to get the support you need when you need it. At Adrian Flux, we offer breakdown cover for recovery trucks, which can help you when the worst happens.

This helps ensure that should something go wrong and you have people depending on you, you can get back on the road as quickly as possible.

Get a Flux Rescue Breakdown Cover Quote

Around-the-clock support

Flux Rescue operates 24 hours a day, 365 days a year. Our trained staff are equipped with the most up-to-date mapping technology and computers to provide a fast and efficient service using a network of over 1,800 breakdown recovery specialists.

FAQs

Can I get cover while travelling in Europe?

Yes, our cover for breakdowns includes cover when travelling in Europe for up to 60 days as standard. If you’re travelling in Europe for over 60 days, please let us know and we can accommodate this.

We can also add cover in the following non-EU countries to your policy if required:

- Albania

- Belarus

- Bosnia and Herzegovina

- Bulgaria

- Estonia

- Hungary

- Latvia

- Lithuania

- Moldova

- Morocco

- Montenegro

- Romania

- Serbia

- The Former Yugoslav Republic of Macedonia (F.Y.R.O.M.)

- Turkey

What is excess on breakdown cover?

Like regular car insurance, breakdown cover has an excess you have agreed to pay in the event you need breakdown assistance. You can find the excess amount in your policy documents. Find out more about insurance excess here.

Can I get breakdown cover for a week?

Yes, we offer temporary breakdown cover for short periods.

What is home start breakdown cover?

Many breakdowns occur in your driveway or up to a mile from your home. For instance, your vehicle might not start because of a dead battery or you might notice a puncture when you park your vehicle.

If you breakdown at or near your place of residence, our approved breakdown agents will attend your vehicle to help.

This helps ensure that should something go wrong and you have people depending on you, you can get back on the road as quickly as possible.

Does breakdown cover include punctures and flat tyres?

Yes, our cover includes assistance for punctures and flat tyres.

How can I tell if I already have breakdown cover?

Check your policy documents to see if you’ve already got breakdown cover. If you’re still not sure, it’s a good idea to use the search function in your emails for “breakdown cover” or contact your insurance provider directly.

How many times can I call out?

There is no limit to how many call outs you can make during the year, but please note that the breakdown labour costs incurred during a 12-month period must not exceed £3,500.

Is breakdown cover included with my insurance?

In general, no – you’ll have to pay extra. At Adrian Flux, we offer among the best rates for breakdown cover in the UK, and premiums are more competitive when you take out motor insurance with breakdown cover.

What should I do if my car breaks down on the road?

Read our blog on what to do if your car breaks down. The first step is to always put your hazards on and try to move over to the side of the road. It’s safer to exit the vehicle and stand behind a barrier if possible.

Is breakdown cover worth it?

Breaking down without insurance tends to be very expensive; motorway towing charges can be as high as £150, the average garage call out charge is £90 and the average call out for a flat battery is £66. As a result, breakdown cover usually pays for itself the first time you need it.

On top of this, breaking down without cover means that getting help usually takes longer. That’s more time spent stranded in the middle of nowhere or stuck on the motorway hard shoulder. As we have such a wide network of approved technicians, we can respond to your claim much quicker than if you don’t have cover for breakdowns.

Can I just buy breakdown cover if I don’t have a car insurance policy with Adrian Flux?

In cases where you’ve already taken out insurance for your vehicle but you need breakdown cover, we offer insurance for breakdowns as a standalone product for £99.

What should I do if my car breaks down at home?

Just give us a call on 0330 123 0758 or 0800 032 5515 and one of our approved garage technicians in the local area will travel to your location and attempt to repair your vehicle. If the car cannot be repaired quickly, Flux Rescue will cover any reasonable costs involved with taking the car to the nearest garage.